salt tax deduction explained

The state and local tax deduction SALT for short was the most significant tax break eliminated under the tax reform framework released by. Beginning in 2018 the itemized deduction for state and local taxes paid will be capped at 10000 per return for single filers head of household filers and married taxpayers filing jointly.

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It

Deductible taxes include state and.

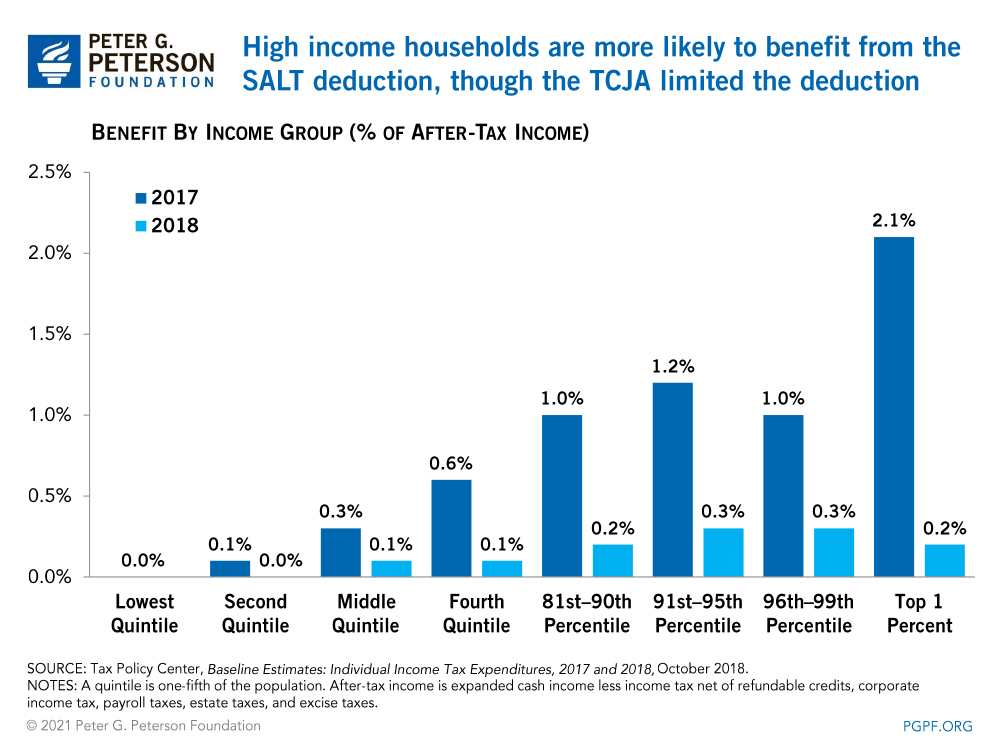

. 53 rows The benefits of the SALT deduction overwhelmingly go to high-income taxpayers particularly. However many filers dont know. Theoretically state and local governments could then use.

TCJA and the 10000 SALT Cap. The federal tax reform law passed on Dec. This report written shortly before the bills final enactment explains how the tax shelter operates and how the new federal tax law expanded its size and scope.

WASHINGTON The Internal Revenue Service today clarified the tax treatment of state and local tax refunds arising from any year in which the new limit on the state and local tax SALT deduction is in effect. The state and local tax SALT deduction permits taxpayers who itemize when filing federal taxes to deduct certain taxes paid to state and local governments. Capping the deduction in 2017 reduced the benefit for people who.

However for individual taxpayers who itemize their deductions the Tax Cuts and Jobs Act TCJA introduced a 10000 limit on state and local taxes paid that an individual can deduct during the year 5000 for married individuals filing. Section 164 of the Internal Revenue Code IRC generally allows a deduction for state and local taxes paid. According to an explanation from the Tax Foundation SALT deduction permits taxpayers who itemize when filing federal taxes to deduct certain taxes paid to state and local governments.

In Revenue Ruling 2019-11 PDF posted today on IRSgov the IRS provided four examples illustrating how the long-standing tax benefit rule interacts with the. Homeowners who itemize deductions on their federal income tax returns have been able to deduct without limit New York State and NYC real estate taxes for decades. With changes to the tax code enacted in the 2017 Tax Cuts and Jobs Act deductions were capped at 10000 starting on January 1 2018.

22 2017 established a new limit on the amount of state and local taxes SALT that can be deducted on a federal income tax return. For anyone that itemizes their personal deductions they can deduct 10000 with the SALT deduction or 5000 for married people filing separately. The SALT deduction has been a part of tax policy since before the federal income tax was created in 1913 and apart from some minor changes in.

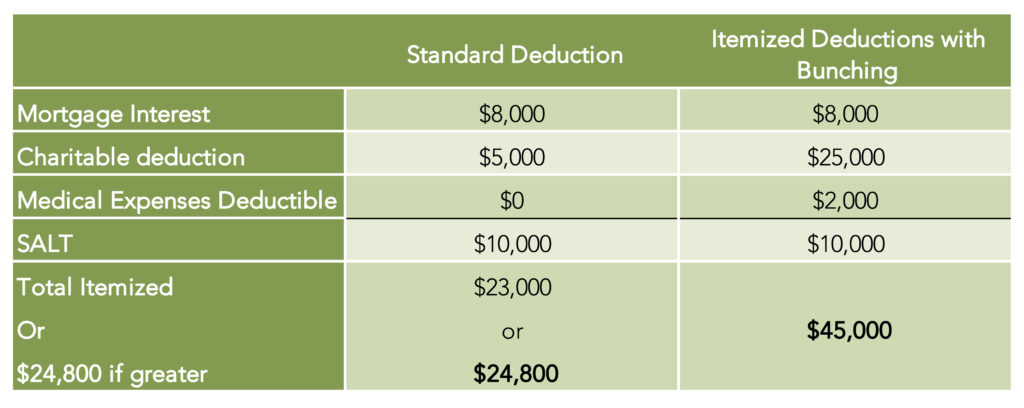

The Tax Cuts and Jobs Act capped it at 10000 per year consisting of property taxes plus state income or sales taxes but not both. Indeed research suggests that the SALT deduction is associated with increased revenues from state and local sources. The Tax Cuts and Jobs Act which took effect in 2018 capped the maximum SALT deduction to 10000 5000 for married individuals filing separately.

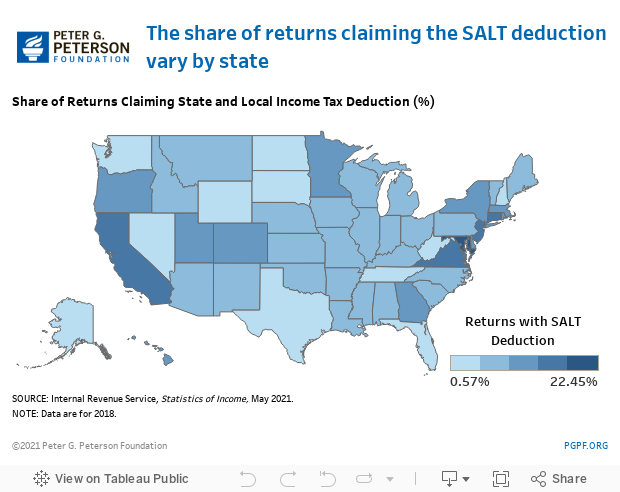

The SALT Deduction or State and Local Tax Deduction allows people to write off their local taxes from their income in federal taxes. The new SALT deduction allows taxpayers to deduct their sales tax state income tax and property tax up to an aggregate 10000 limit. 11 rows The state and local tax SALT deduction allows taxpayers of high-tax states to deduct.

52 rows The state and local tax deduction commonly called the SALT. That limit applies to all the state and local. The SALT deduction cap included in the 2017 federal tax overhaul indirectly expanded a long-running loophole benefiting private K-12 schools.

The Tax Policy Center says that the SALT deduction provides an indirect federal subsidy to state and local governments by decreasing the net cost of nonfederal taxes to those who pay them. The pre-cap SALT deduction allowed people to deduct some state and local taxes to offset federal tax payment effectively subsidizing state and local taxes for taxpayers. The SALT Deduction is currently capped at 10000 so if youre paying more than that in local taxes you wont.

The deduction also incentivized states to tax their residents more progressively since the SALT deduction applies to types of taxes that tend to be progressive like taxes on income. Unfortunately especially for higher income households the SALT deduction has been capped at 10000. The SALT deduction is one tool for redistributing tax revenue but most working people dont have access to it because they dont itemize.

State and Local Tax SALT tax deduction cap explained. House Democrats 175 trillion spending package boosts the limit on the federal deduction for state and local taxes known as SALT to 80000 through 2030.

Changes To The State And Local Tax Salt Deduction Explained Home Improvement Loans Backyard Fall Lawn Care

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It

Tax Deductions Credits What S The Difference Seymour Perry Llc

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_image/image/56916719/855589486.0.jpg)

Trump Is Proposing Big Tax Hikes On Vulnerable House Republicans Constituents Vox

Salt Tax Deduction Will Democrats Cut Taxes For The Rich Steve Forbes What S Ahead Forbes Youtube

Tax Deductions Credits What S The Difference Seymour Perry Llc

How To Deduct State And Local Taxes Above Salt Cap

The Mystockoptions Blog Tax Planning

Salt Tax Deduction Will Democrats Cut Taxes For The Rich Steve Forbes What S Ahead Forbes Youtube

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It

Rsu Taxes Explained 4 Tax Saving Strategies For 2021

The Ultimate 2020 Tax Planning Guide The Motley Fool

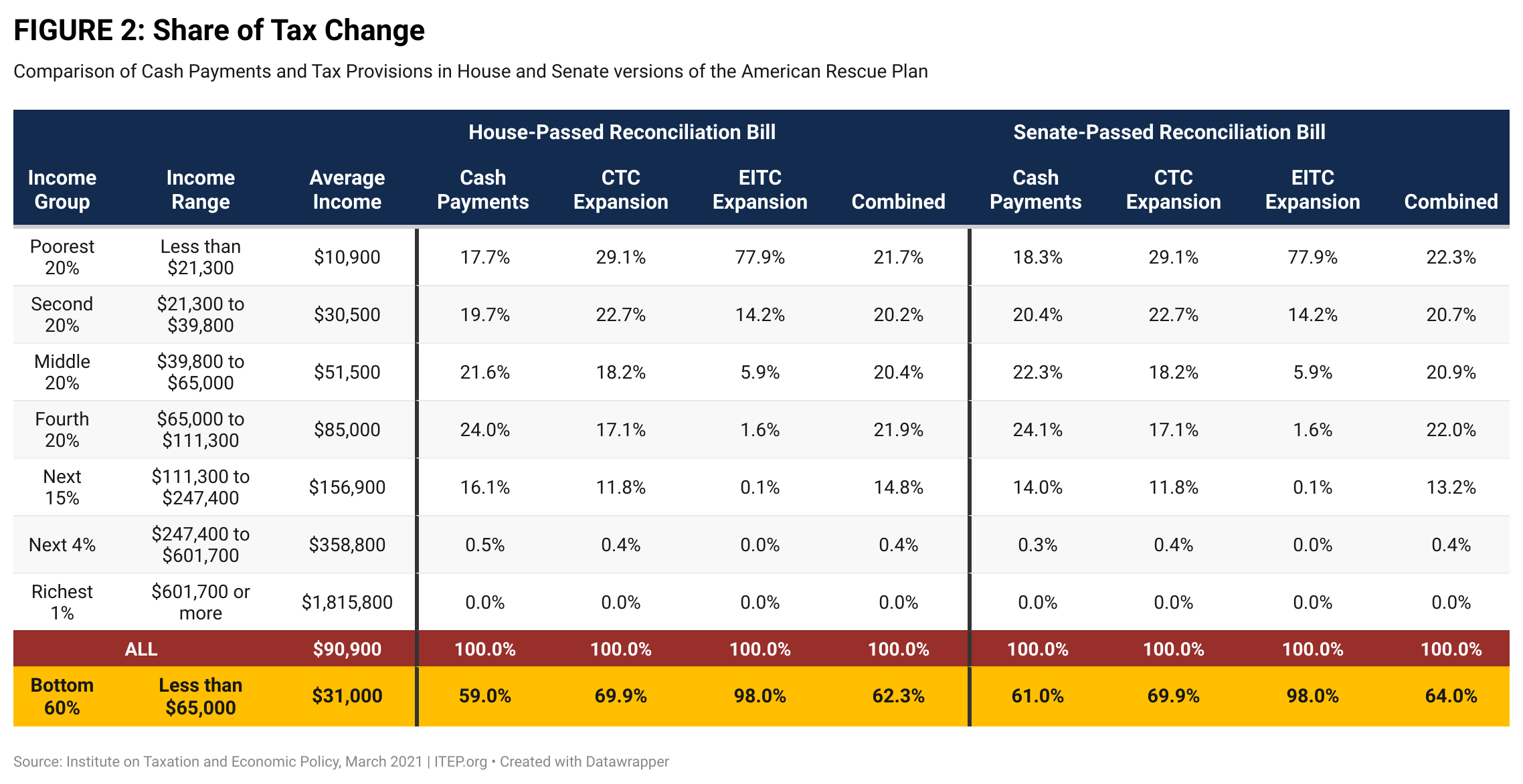

Estimates Of Cash Payment And Tax Credit Provisions In American Rescue Plan Itep

The Mystockoptions Blog Tax Planning

Tax Deductions Credits What S The Difference Seymour Perry Llc

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less